|

|

| WFOE, Wholly Foreign Owned Enterprise, means companies formed in China and its investor(s) are foreign individual or corporate. According to “Company Law” 2006, WFOE can be divide as follow: |

| |

|

|

|

| Company type |

Solo Limited Company |

Limited Company |

Share Limited Company |

| Number of Director |

1 Person |

1-13 Persons |

5-19 Persons |

| Number of Supervisor |

1 Person |

1 Person |

More than 3 Persons |

| Number of Shareholder |

1 Corporate or Individual |

2-50 Persons |

2-200 Perons |

| Minimum Registered Capital |

USD 15,000 |

USD15,000 |

USD 5,000,000 |

|

| |

|

| Registered Capital and Investment amount | |

|

|

| Investment amount (USD) |

Registered Capital Radio |

Minimum Registered Capital |

Time Limit for Registered Capital Payment |

| Less Than 0.5M |

/ |

0.5M |

Within 1 year |

| 0.5M – 1M |

/ |

0.5M |

1 – 1.5 years |

| 1M – 3M |

≥70% |

/ |

1.5 – 2 years |

| 3M – 10M |

≥50% |

2.1M |

Within 3 years |

| 10M – 30M |

≥40% |

5M |

Approved by related department |

| More than 30M |

≥1/3 |

12M |

|

| |

|

| Required Documents of Setting up a WFOE | |

|

|

| Documents |

Description |

Copies |

| Certificate of Incorporation of investor (Please see remarks below) |

If the investor is a corporation, Notarized and Legalized by Notarial Public, Local Foreign Affair Department and Local China Embassy |

1 Original |

| Passport of the investor (Please see remarks below) |

If the investor is a natural person. |

1 Original |

| Annual Audit Report of last year |

Only if the investor has been corporate more than one year. |

1 Original |

| Passport of Mother Company’s Director |

Copies need to be signed. |

2 Copies |

| Bank Reference Letter of the investor |

If the investor is an IBC, then also needs shareholder’s personal bank reference letter. |

1 Original |

| Office Leasing Agreement |

Leasing term needs to be over 1 year. |

3 Original |

|

Real Estate Property Certificate of the Office

|

An owner’s seal on every page. If the property is owned by individual, his/her signature and ID card’s copy are needed. |

2 Copies |

| Real Estate Property Information Sheet |

Issued by Real Estate Property Exchange Centre |

1 Original |

| Passport copies of Directors and Supervisors of the WFOE’s Board Meeting |

Copies need to be signed. |

2 Copies |

| Photos of the Legal Representative of the WFOE |

2 two-inch photos |

2 Photos |

| We draft belows(Will be different according to company type) |

| Capital Audit report |

|

3 Original |

| Feasibility Study Report |

|

1 Original |

| Articles of Association |

|

3 Original |

| Applications Letter |

|

1 Original |

| Authorization Letter |

|

2 Original |

| Board Resolution |

|

3 Original |

| Appointment Letter(Directors, Supervisors and Managers) |

|

2 Original |

|

| |

| Remarks: |

| * |

As a foreign company, all certificates issued by foreign administrations are not admitted by Chinese ones. It can be valued only after legalized by local Chinese Embassy.

Whole notaries acts include:

|

| |

a. |

The copies of company’s original certificates of incorporation need to be notarized by a notaries public in local country. |

| |

b. |

The notarized documents need to be legalized by The Ministry of Foreign Affairs. |

| |

c. |

The legalized documents need to be verified to the local Chinese Embassy. |

**

|

If the investor is from a foreign country which has no diplomatic relations with China, the legalization needs to be settled in a 3rd country which has both diplomatic relations with China and that country. Other producers are the same as above. |

| *** |

HK companies enjoy a much easier producer. A layer who is appointed by Chinese Ministry of Justice can provide the service of transmitting notarization. |

| **** |

If the investor is the natural person of a foreign country, the original passport which contained Chinese visa could be accepted directly in most districts. Inhabits of HK hold Reentry Permit and Taiwanese hold own Taiwan Compatriot Travel Certificate will do. |

| |

|

|

|

| |

|

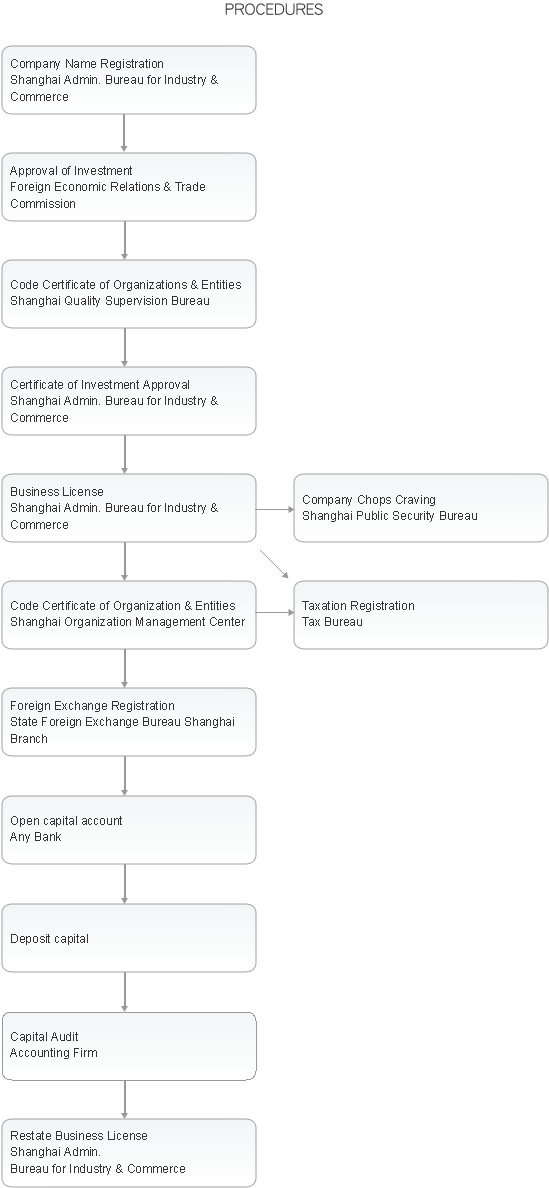

| Governmental Working Days of Setting up a WFOE | |

|

|

|

Items

|

Working Days |

|

Company name Registration

|

5

|

|

Approval of Investment

|

15

|

|

Certificate of Investment Approval

|

5

|

|

Business License

|

10

|

|

Chops and Stamps

|

1

|

|

Code Certificate of Organizations & Entities

|

1

|

|

Foreign Exchange Registration

|

1

|

|

Capital Audit Report

|

10

|

|

Taxation Registration

|

30

|

| Restate the Business License |

5

|

| TOTAL |

83

|

|

| |

|

Remarks:

|

| * |

Registration fee is different according to registration capital. 0.08% for the amount up to 10,000,000 RMB, and 0.04% for the above part. Free of charge for the part over 100,000,000 RMB.

|

| ** |

The cost of capital audit report will be different according to the registration capital and the methods of deposit. Here is an example at 1,000,000 RMB registration capitals. |

|

| |

|

|

Back

|

|

|